Seven Hills Magazine

The original story can be found here: http://www.richardcayne.com/richard-cayne-meyer/richard-cayne-featured-seven-hills-japan-asset-allocation/

As featured in the Seven Hills magazine May 2008 edition: Richard Cayne of Meyer Asset Management in Tokyo Japan explains how asset allocation can sometimes be more important than choosing high growth investments which are all correlated with each other. In other words says Cayne, you don’t want to see all of your assets drop at the same time in a down market. In a properly balanced portfolio one can expect some of the investments to keep steady or even rise when other investments drop. This will help reduce portfolio volatility and ultimately will help deliver an overall better more balanced return.

The original story can be found here: http://www.richardcayne.com/richard-cayne-meyer/richard-cayne-featured-seven-hills-japan-asset-allocation/

As featured in the Seven Hills magazine May 2008 edition: Richard Cayne of Meyer Asset Management in Tokyo Japan explains how asset allocation can sometimes be more important than choosing high growth investments which are all correlated with each other. In other words says Cayne, you don’t want to see all of your assets drop at the same time in a down market. In a properly balanced portfolio one can expect some of the investments to keep steady or even rise when other investments drop. This will help reduce portfolio volatility and ultimately will help deliver an overall better more balanced return.

Seven Hills magazine’s readers are High Net Worth Individuals in Japan

The original story can be found here: http://richardcayne.weebly.com/richard-cayne-meyer/richard-cayne-featured-seven-hills-japan-dollar-cost-averaging

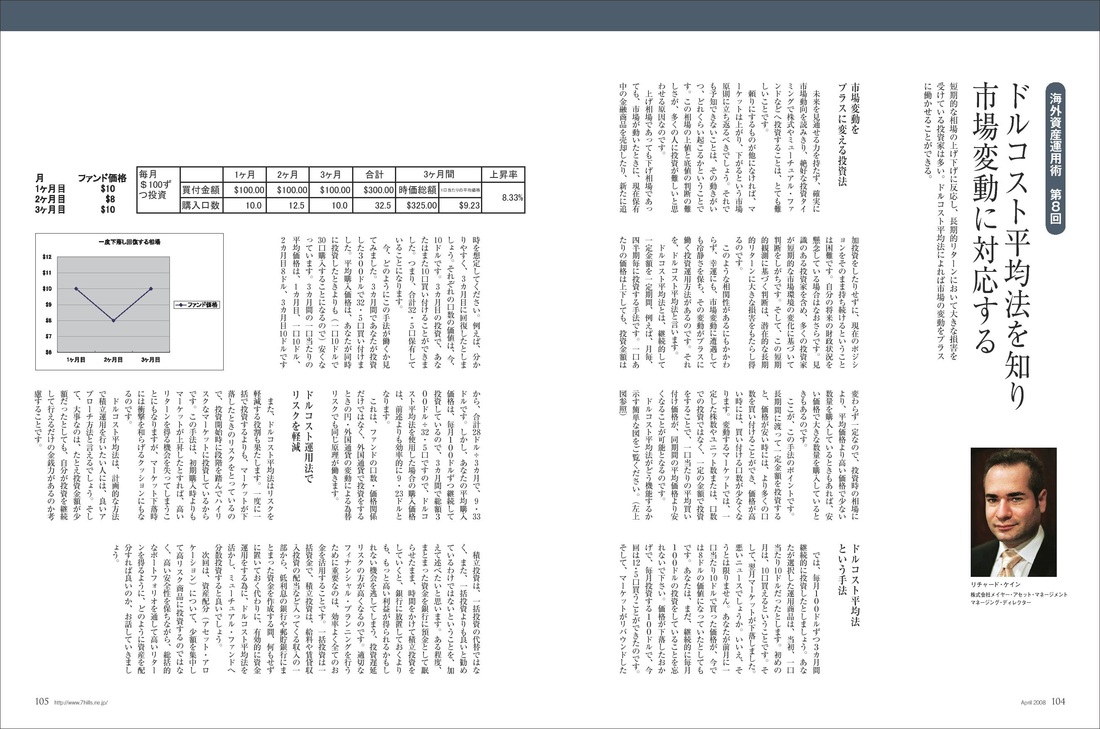

Dollar Cost Averaging

As featured in the Seven Hills magazine April 2008 edition: Dollar cost or unit cost averaging is simply investing over many market entry points of a regular basis. For example one can do monthly or bi annual cost averaging into equity markets or currencies and what you will achieve is an average rate. So if one worries about market risk and timing it is better to spread that risk over many entry points explained Richard Cayne of Meyer Asset Management Ltd in Tokyo Japan. Should the market drop then the good news is that more units are bought with the same amount of money. When the market goes up the good news is that existing units that have already been purchased do rise. Richard Cayne explains that dollar cost or unit cost averaging investment plans are great for any long term investment plan such as towards retirement, Child education fees planning or real estate purchase.

Seven Hills magazine’s readers are High Net Worth Individuals in Japan

The original story can be found here: http://richardcayne.blogspot.com/2015/04/richard-cayne-featured-seven-hills.html

Commodities Inflation

As featured in the Seven Hills magazine September 2008 edition; Commodities says Richard Cayne of Meyer should play a role in everyone’s portfolio to some degree as they can offer diversification into an asset class which is usually associated with hedging inflation risk. Normally over time commodities will keep pace with inflation and therefore a worthwhile addition to an investment portfolio. Commodity investments can take many forms from mutual fund and ETFs to direct holdings i.e. gold bars.

Seven Hills magazine’s readers are High Net Worth Individuals in Japan